All Categories

Featured

Table of Contents

Some instances consist of the liens of certain buyers of securities, liens on certain automobile, and the interest held by a retail purchaser of certain personal effects. Federal regulation additionally enables a stateif the state legislature so elects by statuteto appreciate a greater priority than the government tax lien with regard to specific state tax obligation liens on building where the associated tax obligation is based on the value of that property.

In order to have the record of a lien released a taxpayer should acquire a Certificate of Launch of Federal Tax Obligation Lien. Normally, the IRS will certainly not release a certificate of release of lien up until the tax obligation has either been paid completely or the IRS no more has a legal interest in accumulating the tax obligation.

In scenarios that qualify for the removal of a lien, the IRS will normally get rid of the lien within 30 days and the taxpayer may get a copy of the Certificate of Release of Federal Tax Obligation Lien. how to do tax lien investing. The present type of the Notice of Federal Tax obligation Lien made use of by the internal revenue service contains a provision that provides that the NFTL is launched by its own terms at the final thought of the statute of restrictions duration described over supplied that the NFTL has not been refiled by the day suggested on the type

The term "levy" in this narrow technological sense represents a management activity by the Irs (i.e., without going to court) to confiscate property to please a tax obligation responsibility. The levy "consists of the power of distraint and seizure whatsoever. The general rule is that no court consent is required for the IRS to carry out a section 6331 levy.

The notification of levy is an IRS notification that the IRS means to take residential or commercial property in the close to future. The levy is the real act of seizure of the home. Generally, a Notice of Intent to Levy have to be released by the IRS at the very least thirty days before the real levy.

Bob Diamond

Additionally, while the federal tax lien puts on all residential property and legal rights to residential property of the taxpayer, the power to levy undergoes certain restrictions. That is, specific residential property covered by the lien might be exempt from an administrative levy (residential or commercial property covered by the lien that is excluded from management levy may, however, be taken by the internal revenue service if the IRS gets a court judgment).

In the United States, a tax obligation lien might be put on a residence or any kind of other genuine property on which real estate tax is due (such as a vacant tract of land, a watercraft dock, or perhaps an auto parking place). [] Each county has differing policies and guidelines concerning what tax schedules, and when it is due.

Robert Kiyosaki Tax Lien Investing

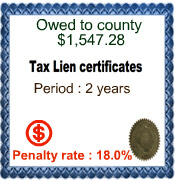

Tax obligation lien certifications are released quickly upon the failure of the residential property owner to pay. The liens are normally in initial placement over every other encumbrance on the home, consisting of liens safeguarded by loans versus the home. Tax obligation lien states are Alabama, Arizona, Colorado, Florida, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maryland, Massachusetts, Mississippi, Missouri, Montana, Nebraska, Nevada, New Jersey, New York, Ohio, Rhode Island, South Carolina, Vermont, West Virginia, and Wyoming.

Tax actions are provided after the proprietor of the residential property has actually failed to pay the tax obligations. Tax obligation acts are released about public auctions in which the residential or commercial property is marketed outright. The starting bid is frequently just for the back tax obligations owed, although the scenario might differ from one county to one more.

"Tax Act States 2024". Tax liens and tax obligation actions can be purchased by a specific capitalist. In the situation of tax obligation liens, passion can be earned. If the property is retrieved after that the capitalist would recover spent cash, plus passion due after the lien was bought. If the home is not redeemed, the deed holder or lien holder has initial position to own the residential or commercial property after any various other taxes or costs are due. [] 6321.

See 26 U.S.C. 6203. See 26 C.F.R. section 601.103(a). 326 U.S. 265 (1945 ). See 26 U.S.C. 6323. U.S. Constit., art. VI, cl. 2; And this: "The kind and web content of the notice described in subsection (a) will be suggested by the Assistant [of the Treasury or his delegate]

The notice referred to in 301.6323(a)-1 will be filed on Type 668, 'Notice of Federal Tax Lien under Internal Income Laws'. Such notification is valid regardless of any type of various other provision of law pertaining to the kind or content of a notice of lien.

Tax Lien Investing Scam

See Internal Profits Code areas 6334(a)( 13 )(B) and 6334(e)( 1 ). Area 6334 also offers that certain assets are not subject to an Internal revenue service levy, such as particular using clothing, gas, furnishings and family effects, particular publications and devices of trade of the taxpayer's occupation, undelivered mail, the part of salary, wages, and so on, needed to support minor youngsters, and certain other properties.

Beginning January 1, 2015, the Mississippi Department of Profits will certainly enlist tax obligation liens for unsettled tax financial obligations online on the State Tax Lien Windows Registry. Tax obligation liens will no more be taped with Circuit Staffs. A tax lien videotaped on the State Tax Lien Windows registry covers all residential property in Mississippi. To stay clear of having a tax obligation lien filed against your building, send the Division of Revenue full repayment before the due date as stated in your Assessment Notice.

Tax Ease Lien Investments

The State Tax Lien Registry is a public site easily accessible on the internet that might be searched by anyone at any time. Unlike tax obligation returns, tax obligation liens are a public notice of financial debt.

For an individual noted on the State Tax Obligation Lien Pc registry, any type of actual or individual home that the person has or later on acquires in Mississippi is subject to a lien. The lien signed up on the State Tax Obligation Lien Windows registry does not identify a specific item of building to which a lien uses.

What Is Tax Lien Real Estate Investing

Tax liens are noted on your credit score record and reduced your credit history score, which may impact your capability to get finances or financing. Mississippi law allows extensions on state liens up until they're paid in complete; so extensions can be filed repeatedly making a tax lien valid forever.

The lien consists of the quantity of the tax obligation, charge, and/ or interest at the time of enrollment. Enrollment of the tax obligation lien offers the Department a legal right or passion in a person's property till the liability is satisfied. The tax lien might attach to genuine and/or personal effects any place located in Mississippi.

The Commissioner of Income sends by mail an Evaluation Notice to the taxpayer at his last well-known address. The taxpayer is given 60 days from the mailing day of the Assessment Notification to either totally pay the analysis or to appeal the evaluation. A tax lien is cancelled by the Department when the misbehavior is paid completely.

If the lien is paid by any type of other ways, after that the lien is cancelled within 15 days. When the lien is terminated, the State Tax Lien Pc registry is upgraded to reflect that the financial obligation is satisfied. A Lien Cancellation Notification is sent by mail to the taxpayer after the financial obligation is paid completely.

Enlisting or re-enrolling a lien is not subject to management appeal. If the individual thinks the lien was filed in mistake, the individual needs to contact the Division of Profits immediately and request that the declaring be assessed for correctness. The Division of Revenue may ask for the taxpayer to submit paperwork to support his case.

Latest Posts

Tax Lien Certificate Investments

Delinquent Tax Deed Sale

Tax Lien Tax Deed Investing