All Categories

Featured

Table of Contents

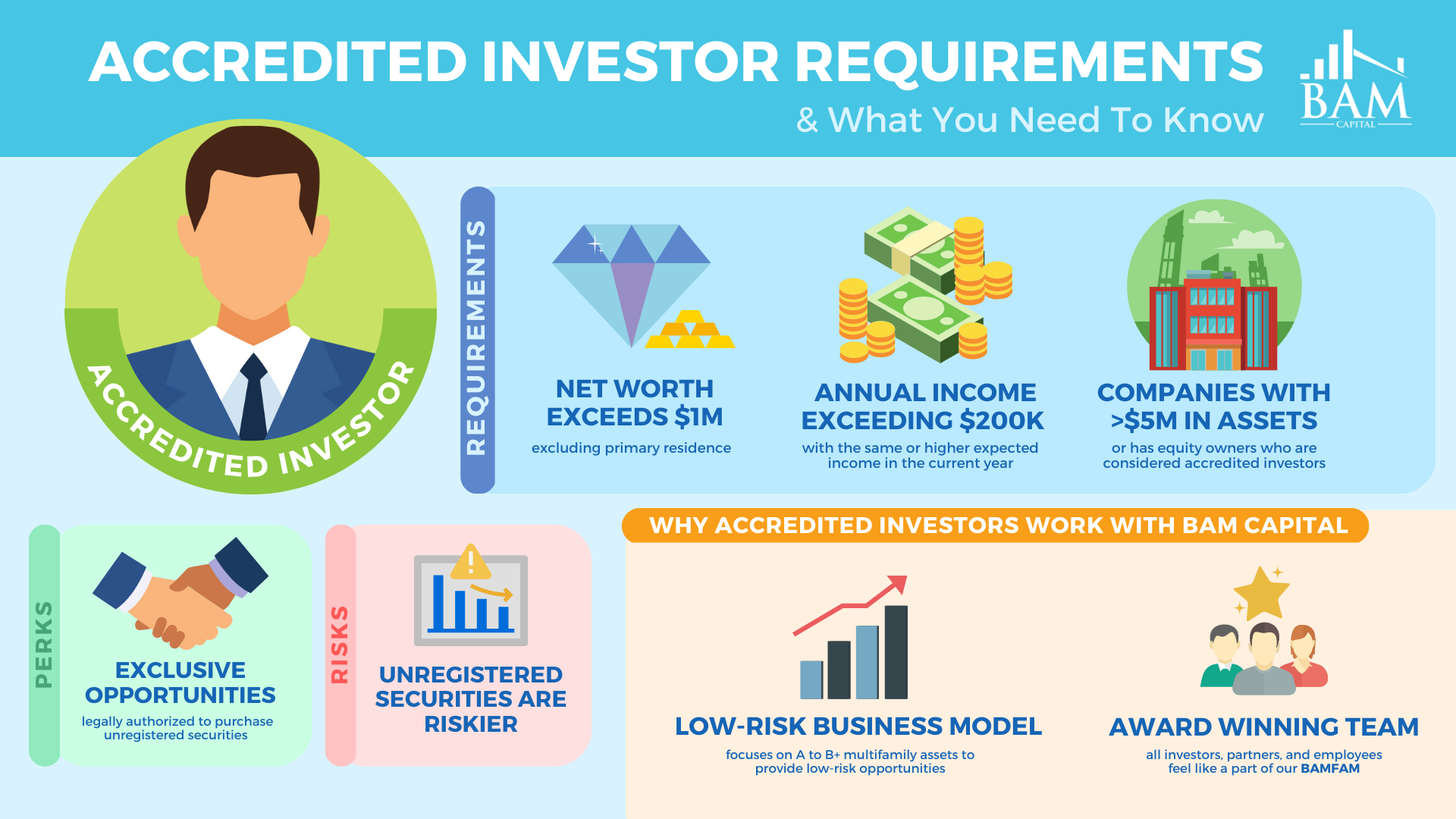

Investments include threat; Equitybee Securities, participant FINRA Accredited investors are one of the most competent financiers in business. To certify, you'll require to fulfill one or even more needs in revenue, internet worth, asset dimension, governance standing, or professional experience. As a recognized financier, you have accessibility to more intricate and innovative types of protections.

Enjoy access to these alternate financial investment chances as a recognized investor. Certified financiers generally have a revenue of over $200,000 separately or $300,000 jointly with a partner in each of the last 2 years.

Custom Accredited Investor High Return Investments

To make, you simply require to join, purchase a note offering, and wait on its maturity. It's a wonderful source of passive earnings as you do not need to monitor it carefully and it has a brief holding duration. Excellent annual returns vary between 15% and 24% for this possession class.

Prospective for high returnsShort holding duration Resources in danger if the debtor defaults AssetsContemporary ArtMinimum Investment$15,000 Target Holding Period3-10 Years Masterworks is a system that securitizes excellent art work for investments. It purchases an artwork with public auction, after that it signs up that possession as an LLC. Starting at $15,000, you can buy this low-risk possession course.

Acquire when it's used, and after that you obtain pro-rated gains when Masterworks markets the art work. Although the target period is 3-10 years, when the artwork reaches the wanted worth, it can be offered previously. On its website, the most effective admiration of an art work was a whopping 788.9%, and it was only held for 29 days.

Its minimum begins at $10,000. Yieldstreet has the widest offering across different investment systems, so the amount you can make and its holding duration differ. There are items that you can hold for as brief as 3 months and as lengthy as 5 years. Normally, you can earn via rewards and share recognition with time.

High-End High Yield Investment Opportunities For Accredited Investors

One of the drawbacks below is the reduced yearly return rate compared to specialized systems. Its management cost usually ranges from 1% - 4% annually. accredited investor syndication deals.

In addition, it obtains rental fee earnings from the farmers during the holding period. As a capitalist, you can earn in two means: Receive dividends or cash money return every December from the rent paid by renter farmers.

World-Class High Yield Investment Opportunities For Accredited Investors

Farmland as an asset has historically reduced volatility, which makes this a terrific alternative for risk-averse financiers. That being said, all investments still carry a particular degree of threat.

Additionally, there's a 5% cost upon the sale of the whole property. Secure possession Yearly cash return AssetsCommercial Real EstateMinimum InvestmentMarketplace/C-REIT: $25,000; Thematic Finances: $100,000+Target Holding PeriodVaries; 3 - 10 Years CrowdStreet is a business actual estate investment platform. It buys different offers such as multifamily, self-storage, and commercial homes.

Managed fund by CrowdStreet Advisors, which instantly expands your investment across numerous homes. accredited investor passive income programs. When you buy a CrowdStreet offering, you can get both a money yield and pro-rated gains at the end of the holding duration. The minimal investment can vary, but it usually starts at $25,000 for market offerings and C-REIT

Property can be commonly reduced risk, but returns are not assured. While some possessions might return 88% in 0.6 years, some assets lose their worth 100%. In the history of CrowdStreet, even more than 10 homes have adverse 100% returns. CrowdStreet does not bill any charges, but you may need to pay sponsors costs for the administration of the properties.

Top-Rated Top Investment Platforms For Accredited Investors for Accredited Investor Platforms

While you will not get possession below, you can possibly get a share of the revenue once the start-up efficiently does an exit occasion, like an IPO or M&A. Several good business continue to be exclusive and, therefore, frequently hard to reach to financiers. At Equitybee, you can money the supply alternatives of staff members at Red stripe, Reddit, and Starlink.

The minimal financial investment is $10,000. This platform can possibly provide you large returns, you can additionally shed your entire cash if the startup falls short. Because the transfer of the securities is hand-operated, there's a threat that staff members will decline to comply with the contract. In this instance, Equitybee will certainly exercise its power of lawyer to inform the company of the supply to launch the transfer.

When it's time to exercise the alternative during an IPO or M&A, they can profit from the potential boost of the share rate by having a contract that enables them to buy it at a discount rate (high yield investment opportunities for accredited investors). Accessibility Thousands Of Start-ups at Past Valuations Diversify Your Portfolio with High Growth Start-ups Spend in a Formerly Hard To Reach Asset Course Based on accessibility

It can either be 3, 6, or 9 months long and has a fixed APY of 6% to 7.4%. Historically, this income fund has actually exceeded the Yieldstreet Option Revenue Fund (previously recognized as Yieldstreet Prism Fund) and PIMCO Revenue Fund.

Esteemed Accredited Investor Investment Returns

Plus, they no longer release the historic efficiency of each fund. Short-term note with high returns Absence of openness Facility fees framework You can certify as a recognized financier utilizing 2 criteria: economic and specialist abilities.

There's no "test" that grants an accreditor financier permit. One of one of the most vital things for a certified investor is to secure their funding and grow it at the same time, so we selected properties that can match such various threat hungers. Modern investing systems, especially those that provide alternative assets, can be fairly unforeseeable.

To make sure that accredited investors will certainly be able to create a comprehensive and diverse profile, we picked platforms that can fulfill each liquidity demand from short-term to lasting holdings. There are numerous financial investment chances recognized capitalists can discover. Yet some are riskier than others, and it would certainly depend on your threat cravings whether you 'd go all out or not.

Recognized financiers can expand their financial investment profiles by accessing a more comprehensive range of asset classes and financial investment approaches. This diversification can help alleviate risk and enhance their overall portfolio performance (by preventing a high drawdown portion) by decreasing the reliance on any single investment or market sector. Accredited financiers commonly have the opportunity to attach and team up with other like-minded investors, industry experts, and entrepreneurs.

Latest Posts

Tax Lien Certificate Investments

Delinquent Tax Deed Sale

Tax Lien Tax Deed Investing